Understanding Social Security Benefits

Social Security is a government program that provides financial assistance to individuals who are retired, disabled, or survivors of deceased workers. It is funded through payroll taxes and is designed to provide a safety net for individuals who are no longer able to work. There are several different types of Social Security benefits, including retirement benefits, disability benefits, and survivor benefits.

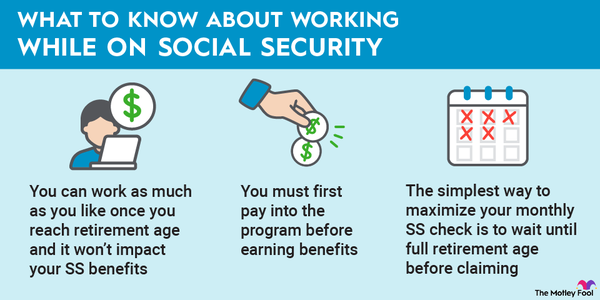

One important thing to understand about Social Security benefits is that the amount you receive is based on your earnings history. The more you earn during your working years, the higher your benefit will be. It’s also important to know that you can start receiving Social Security benefits as early as age 62, but your benefit amount will be reduced if you choose to start receiving benefits before your full retirement age.

Another key point to keep in mind is that Social Security benefits are adjusted for inflation each year. This means that the amount you receive will increase over time to keep pace with the rising cost of living. It’s important to factor this into your retirement planning to ensure that you will have enough income to support yourself in your later years.

In summary, understanding how Social Security benefits work is crucial for planning your retirement. By knowing how your benefit amount is calculated, when you can start receiving benefits, and how benefits are adjusted for inflation, you can make informed decisions about when to retire and how to maximize your Social Security income.

Maximizing Your Social Security Benefits

One way to maximize your Social Security benefits is to delay claiming them until you reach your full retirement age. By waiting to start receiving benefits, you can increase your monthly benefit amount by as much as 8% per year. This can add up to a significant increase in your lifetime benefit amount, especially if you live a long life.

Another strategy for maximizing your Social Security benefits is to continue working past your full retirement age. If you continue working and earning income, your benefit amount will be recalculated each year to take into account your additional earnings. This can lead to a higher benefit amount in the long run.

It’s also important to consider your spouse’s Social Security benefits when planning for retirement. If you are married, you may be eligible to receive spousal benefits based on your spouse’s earnings history. This can be a valuable source of additional income in retirement.

In conclusion, there are several strategies you can use to maximize your Social Security benefits. By delaying claiming benefits, continuing to work past your full retirement age, and considering spousal benefits, you can increase your monthly benefit amount and secure a more comfortable retirement.

Planning for Social Security in Retirement

When planning for retirement, it’s important to consider how Social Security benefits will factor into your overall financial picture. Social Security benefits are designed to provide a safety net for retirees, but they may not be enough to cover all of your expenses in retirement. It’s important to have other sources of income, such as savings, investments, or a pension, to supplement your Social Security benefits.

One thing to keep in mind when planning for Social Security in retirement is the impact of taxes on your benefits. Depending on your total income in retirement, a portion of your Social Security benefits may be subject to federal income tax. It’s important to understand how taxes will affect your benefits so that you can plan accordingly.

Another consideration when planning for Social Security in retirement is your health care costs. Medicare is the primary source of health insurance for retirees, but it does not cover all medical expenses. It’s important to budget for out-of-pocket medical costs when planning for retirement, especially as you age and may require more health care services.

In summary, planning for Social Security in retirement requires careful consideration of your overall financial situation. By understanding how Social Security benefits fit into your retirement income plan, considering the impact of taxes on your benefits, and budgeting for health care costs, you can create a solid financial plan for your retirement years.

Common Social Security Mistakes to Avoid

One common mistake that people make when it comes to Social Security is claiming benefits too early. While you can start receiving benefits as early as age 62, your benefit amount will be reduced for each year you claim benefits before your full retirement age. By waiting to claim benefits, you can increase your monthly benefit amount and maximize your lifetime benefit.

Another mistake to avoid is not considering the impact of taxes on your Social Security benefits. Depending on your total income in retirement, a portion of your Social Security benefits may be subject to federal income tax. It’s important to understand how taxes will affect your benefits so that you can plan accordingly and avoid any surprises come tax time.

One more common mistake is not factoring in your spouse’s benefits when planning for retirement. If you are married, you may be eligible to receive spousal benefits based on your spouse’s earnings history. By considering both your benefit and your spouse’s benefit, you can maximize your total Social Security income in retirement.

In conclusion, there are several common mistakes to avoid when it comes to Social Security. By waiting to claim benefits, considering the impact of taxes, and factoring in spousal benefits, you can make informed decisions that will maximize your Social Security income in retirement.

Applying for Social Security Benefits

Applying for Social Security benefits is a relatively straightforward process, but there are a few things to keep in mind to ensure a smooth application experience. The first step in applying for benefits is to determine when you want to start receiving benefits. You can start receiving benefits as early as age 62, but your benefit amount will be reduced if you choose to start receiving benefits before your full retirement age.

Once you have decided when you want to start receiving benefits, you can apply for benefits online, by phone, or in person at your local Social Security office. When applying for benefits, you will need to provide documentation that verifies your identity, age, and earnings history. It’s important to have this documentation ready before you start the application process to prevent any delays in receiving your benefits.

After you have submitted your application, it can take several weeks to several months for your benefits to start. It’s important to be patient and follow up with the Social Security Administration if you have not heard back about your application within a reasonable amount of time. Once your benefits start, you can expect to receive monthly payments for as long as you are eligible to receive benefits.

In summary, applying for Social Security benefits is a simple process that requires some preparation and patience. By understanding the steps involved in the application process, gathering the necessary documentation, and following up with the Social Security Administration as needed, you can start receiving your benefits in a timely manner.

Understanding Social Security Disability Benefits

Social Security Disability benefits are available to individuals who are unable to work due to a disabling condition. To qualify for disability benefits, you must have a medical condition that is expected to last for at least one year or result in death. You must also be unable to engage in substantial gainful activity due to your condition.

One key point to understand about Social Security Disability benefits is that there is a waiting period before you can start receiving benefits. The waiting period is typically five months from the date you become disabled, and benefits are not paid for the first five months of disability. This waiting period is designed to ensure that only individuals with long-term disabilities receive benefits.

Another important aspect of Social Security Disability benefits is the medical evaluation process. When you apply for disability benefits, the Social Security Administration will review your medical records and may require you to undergo a medical examination to assess your condition. It’s important to provide thorough and accurate medical documentation to support your claim for disability benefits.

In conclusion, Social Security Disability benefits provide financial assistance to individuals who are unable to work due to a disabling condition. By understanding the eligibility requirements, waiting period, and medical evaluation process, you can navigate the disability benefits application process and secure the financial support you need.

Protecting Your Social Security Information

Protecting your Social Security information is crucial to prevent identity theft and fraud. Your Social Security number is a unique identifier that can be used to access sensitive personal and financial information. To protect your Social Security information, it’s important to keep your Social Security card in a secure place and only share your Social Security number with trusted individuals and organizations.

One way to protect your Social Security information is to be cautious about who you share it with. Avoid giving out your Social Security number unless it is absolutely necessary, and never share it over the phone or via email unless you have verified the identity of the person or organization requesting it. Be wary of unsolicited requests for your Social Security number, as these may be attempts to steal your identity.

Another important step to protect your Social Security information is to regularly review your Social Security earnings statement. Your earnings statement lists your annual earnings and the amount of Social Security taxes you have paid. By reviewing your earnings statement each year, you can detect any errors or fraudulent activity that may indicate someone is using your Social Security number without your permission.

In summary, protecting your Social Security information is essential to safeguard your personal and financial information. By keeping your Social Security card secure, being cautious about who you share your Social Security number with, and regularly reviewing your earnings statement, you can reduce the risk of identity theft and fraud.

Appealing a Social Security Decision

If your application for Social Security benefits is denied, you have the right to appeal the decision. The appeals process allows you to request a review of the denial and present additional evidence to support your claim for benefits. It’s important to understand the appeals process and take the necessary steps to appeal a Social Security decision.

The first step in appealing a Social Security decision is to request a reconsideration of your claim. This involves submitting a written request for a review of the denial and any additional evidence that supports your claim for benefits. The Social Security Administration will review your claim and make a decision on whether to approve or deny your benefits.

If your claim is denied upon reconsideration