Understanding Catch-Up Contributions

Catch-up contributions are additional contributions that individuals aged 50 and older can make to their retirement accounts. These contributions are designed to help older individuals boost their retirement savings as they near retirement age. Catch-up contributions are allowed in addition to the regular contribution limits set by the IRS for retirement accounts such as 401(k) plans, IRAs, and other similar accounts.

One of the main benefits of catch-up contributions is that they allow individuals who may not have saved enough for retirement earlier in their careers to make up for lost time. By making catch-up contributions, older individuals can take advantage of the higher contribution limits allowed by the IRS and potentially increase their retirement savings significantly.

It’s important to note that catch-up contributions are not automatic – individuals must actively choose to make these additional contributions to their retirement accounts. The IRS sets specific limits each year for catch-up contributions, so it’s essential to stay informed about the current limits and take advantage of this opportunity if you are eligible.

Eligibility for Catch-Up Contributions

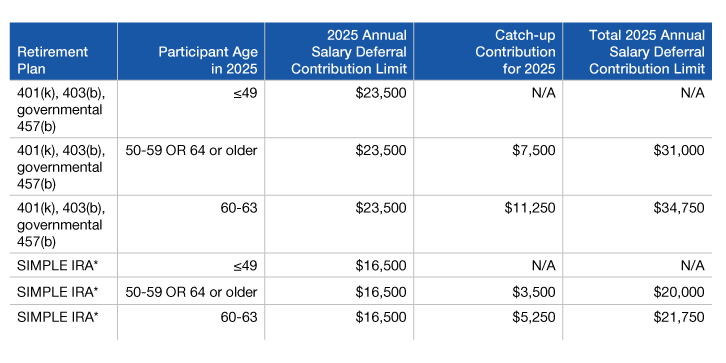

To be eligible to make catch-up contributions, individuals must meet certain criteria set by the IRS. Generally, individuals must be age 50 or older by the end of the calendar year to qualify for catch-up contributions. This age limit applies to most retirement accounts, including 401(k) plans, 403(b) plans, and IRAs.

In addition to meeting the age requirement, individuals must also meet certain income limits to be eligible for catch-up contributions. For example, individuals contributing to a traditional IRA must meet specific income limits to qualify for catch-up contributions. It’s essential to review the IRS guidelines for each type of retirement account to determine if you are eligible to make catch-up contributions.

If you are eligible to make catch-up contributions, it’s important to consider how much you can contribute and how it will impact your overall retirement savings strategy. Working with a financial advisor can help you determine the best approach for maximizing your retirement savings through catch-up contributions.

Types of Retirement Accounts that Allow Catch-Up Contributions

Several types of retirement accounts allow catch-up contributions, including 401(k) plans, 403(b) plans, and IRAs. Each type of account has its own rules and limits for catch-up contributions, so it’s essential to understand the specific guidelines for each account.

For example, 401(k) plans allow individuals aged 50 and older to make catch-up contributions of up to $6,500 in addition to the regular contribution limit set by the IRS. This can help older individuals boost their retirement savings significantly and make up for any missed opportunities to save earlier in their careers.

Similarly, 403(b) plans also allow catch-up contributions for individuals aged 50 and older. The IRS sets specific limits each year for catch-up contributions to 403(b) plans, so it’s important to stay informed about the current limits and take advantage of this opportunity if you are eligible.

Finally, IRAs also allow catch-up contributions for individuals aged 50 and older. Traditional IRAs and Roth IRAs have different rules and limits for catch-up contributions, so it’s essential to review the IRS guidelines for each type of IRA to determine how much you can contribute.

Benefits of Making Catch-Up Contributions

There are several benefits to making catch-up contributions to your retirement accounts. One of the main advantages is that catch-up contributions can help older individuals boost their retirement savings significantly and make up for any missed opportunities to save earlier in their careers. By taking advantage of the higher contribution limits allowed by the IRS, individuals can increase their retirement savings and potentially achieve their retirement goals sooner.

In addition to increasing retirement savings, catch-up contributions can also provide tax benefits for individuals. Contributions to traditional IRAs and 401(k) plans are often tax-deductible, meaning that individuals can reduce their taxable income by making catch-up contributions. This can help individuals lower their tax liability and potentially save more for retirement in the long run.

Finally, making catch-up contributions can help individuals secure their financial future and ensure a comfortable retirement. By maximizing their retirement savings through catch-up contributions, individuals can create a solid financial foundation for their retirement years and enjoy peace of mind knowing that they are prepared for the future.

How to Make Catch-Up Contributions

Making catch-up contributions to your retirement accounts is a straightforward process. Once you determine that you are eligible to make catch-up contributions, you can contact your plan administrator or financial institution to set up the additional contributions.

For employer-sponsored retirement plans such as 401(k) plans and 403(b) plans, you may need to complete a catch-up contribution form to indicate the amount you wish to contribute. Your plan administrator can provide you with the necessary forms and information to set up catch-up contributions to your account.

For IRAs, you can typically make catch-up contributions when you file your taxes for the year. Be sure to indicate on your tax return that you are making catch-up contributions to your IRA and specify the amount you wish to contribute. Your financial institution can provide you with additional guidance on how to make catch-up contributions to your IRA.

It’s important to review the IRS guidelines for catch-up contributions and work with a financial advisor to ensure that you are maximizing your retirement savings through catch-up contributions. By taking advantage of this opportunity, you can boost your retirement savings and secure your financial future.

Considerations for Making Catch-Up Contributions

Before making catch-up contributions to your retirement accounts, it’s essential to consider how this will impact your overall financial situation. Making catch-up contributions can help you boost your retirement savings, but it’s important to ensure that you are still meeting your other financial goals and obligations.

For example, if you have high-interest debt or other financial priorities, it may be more beneficial to focus on paying off debt or building an emergency fund before making catch-up contributions to your retirement accounts. It’s essential to balance your financial priorities and make strategic decisions about where to allocate your money to achieve your long-term financial goals.

Additionally, it’s important to review your retirement savings strategy and consider how catch-up contributions fit into your overall plan. Working with a financial advisor can help you determine the best approach for maximizing your retirement savings through catch-up contributions and ensure that you are on track to achieve your retirement goals.

Ultimately, making catch-up contributions can be a valuable tool for boosting your retirement savings and securing your financial future. By carefully considering your financial situation and working with a financial advisor, you can make informed decisions about making catch-up contributions and ensure that you are on track to achieve a comfortable retirement.

Conclusion

In conclusion, catch-up contributions are a valuable tool for individuals aged 50 and older to boost their retirement savings and secure their financial future. By taking advantage of the higher contribution limits allowed by the IRS, older individuals can make up for any missed opportunities to save earlier in their careers and increase their retirement savings significantly.

To be eligible for catch-up contributions, individuals must meet certain criteria set by the IRS, including age requirements and income limits. It’s essential to review the guidelines for each type of retirement account to determine if you are eligible to make catch-up contributions and take advantage of this opportunity.

Making catch-up contributions is a straightforward process that can provide several benefits, including increased retirement savings, tax advantages, and financial security in retirement. By carefully considering your financial situation and working with a financial advisor, you can make informed decisions about making catch-up contributions and ensure that you are on track to achieve your retirement goals.