Introduction to Simple Retirement Calculator

Retirement planning is an essential aspect of financial management that everyone should prioritize. A simple retirement calculator is a useful tool that helps individuals estimate how much they need to save for their retirement years. By inputting key financial information such as current age, desired retirement age, annual income, and expected rate of return, the calculator can provide an estimate of the amount needed for retirement. This estimate can serve as a guiding tool for individuals to plan their savings and investments accordingly.

When it comes to retirement planning, one of the biggest challenges that individuals face is figuring out how much they need to save. Many people underestimate the amount needed for retirement and end up falling short of their financial goals. A simple retirement calculator can help individuals get a clearer picture of their retirement needs and take proactive steps to achieve those goals. By using a retirement calculator, individuals can make informed decisions about their savings and investments, ensuring a comfortable retirement lifestyle.

In addition to estimating the amount needed for retirement, a simple retirement calculator can also help individuals assess their current financial situation and identify areas for improvement. By inputting their current savings, investments, and other assets, individuals can see how well prepared they are for retirement. This can help individuals make necessary adjustments to their savings and investment strategies to ensure a secure financial future.

Benefits of Using a Simple Retirement Calculator

There are several benefits to using a simple retirement calculator to plan for retirement. One of the main advantages is that it provides individuals with a clear estimate of how much they need to save for retirement. This can help individuals set realistic financial goals and create a savings plan that aligns with their retirement needs. By having a target amount in mind, individuals can track their progress and make adjustments as needed to stay on track.

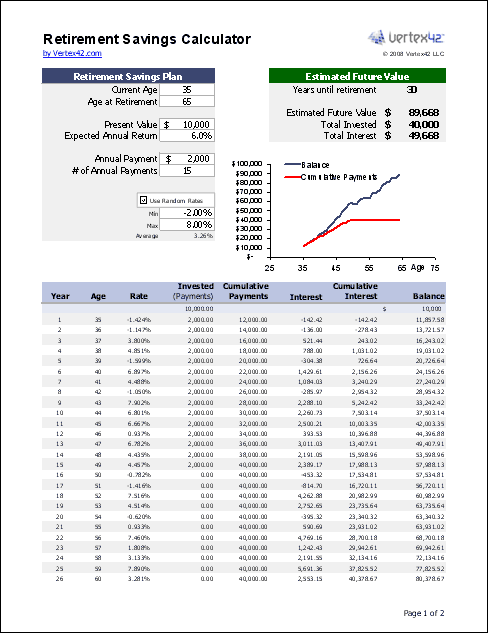

Another benefit of using a retirement calculator is that it can help individuals visualize the impact of different savings and investment strategies. By adjusting the inputs such as annual savings amount and expected rate of return, individuals can see how these factors affect their retirement savings over time. This can help individuals make informed decisions about where to allocate their savings and investments to maximize their retirement funds.

Furthermore, a simple retirement calculator can help individuals identify potential gaps in their retirement savings and take corrective action. By comparing the estimated retirement needs with their current savings and investments, individuals can see if they are on track to meet their financial goals. If there is a shortfall, individuals can explore options such as increasing their savings rate, adjusting their investment portfolio, or exploring other retirement income sources to bridge the gap.

Key Features of a Simple Retirement Calculator

A simple retirement calculator typically includes several key features that make it easy for individuals to estimate their retirement needs. One of the main features is the ability to input key financial information such as current age, desired retirement age, annual income, and expected rate of return. By entering this information, individuals can get an accurate estimate of how much they need to save for retirement.

Another key feature of a retirement calculator is the ability to adjust different variables to see how they impact retirement savings. For example, individuals can change the annual savings amount or the expected rate of return to see how these factors affect their retirement funds. This flexibility can help individuals customize their retirement savings plan to meet their specific financial goals and risk tolerance.

Additionally, many retirement calculators also provide visual representations of retirement savings over time. Graphs and charts can help individuals see how their savings grow over the years and identify potential areas for improvement. This visual representation can make it easier for individuals to understand complex financial concepts and make informed decisions about their retirement planning.

How to Use a Simple Retirement Calculator

Using a simple retirement calculator is easy and straightforward. To get started, individuals need to gather key financial information such as their current age, desired retirement age, annual income, and expected rate of return. Once this information is gathered, individuals can input these variables into the retirement calculator to get an estimate of their retirement needs.

After entering the required information, the retirement calculator will generate an estimate of how much individuals need to save for retirement. This estimate can serve as a benchmark for individuals to plan their savings and investments accordingly. Individuals can also adjust different variables such as annual savings amount and expected rate of return to see how these factors impact their retirement savings over time.

Once individuals have a clear estimate of their retirement needs, they can create a savings plan that aligns with their financial goals. By setting aside a portion of their income for retirement savings and investing in a diversified portfolio, individuals can work towards building a secure financial future. Regularly reviewing and adjusting the savings plan can help individuals stay on track and achieve their retirement goals.

Factors to Consider When Using a Simple Retirement Calculator

While a simple retirement calculator can provide valuable insights into retirement planning, there are several factors to consider when using this tool. One important factor is the accuracy of the inputs used in the calculator. Individuals should ensure that they provide accurate and up-to-date information to get an estimate that reflects their actual retirement needs.

Another factor to consider is the assumptions used in the retirement calculator, such as the expected rate of return on investments. Individuals should be aware that these assumptions may not be guaranteed and can vary over time. It is important to review and adjust these assumptions periodically to ensure that the retirement estimate remains realistic and aligned with current market conditions.

Additionally, individuals should consider their risk tolerance and financial goals when using a retirement calculator. While the calculator can provide a general estimate of retirement needs, individuals should customize their savings and investment strategies based on their personal circumstances. By considering factors such as risk tolerance, time horizon, and retirement lifestyle preferences, individuals can create a customized retirement plan that meets their specific needs.

Common Mistakes to Avoid When Using a Simple Retirement Calculator

When using a simple retirement calculator, there are several common mistakes that individuals should avoid to ensure an accurate estimate of their retirement needs. One common mistake is underestimating the amount needed for retirement. Individuals should be realistic about their retirement lifestyle expectations and factor in potential healthcare costs, inflation, and other expenses that may arise during retirement.

Another common mistake is not updating the inputs and assumptions used in the retirement calculator regularly. Market conditions, interest rates, and personal financial circumstances can change over time, affecting the accuracy of the retirement estimate. Individuals should review and adjust their inputs periodically to ensure that the retirement plan remains on track.

Furthermore, individuals should be cautious about relying solely on the retirement calculator for financial planning. While the calculator can provide valuable insights, it is important to consult with a financial advisor or planner to create a comprehensive retirement strategy. A professional can help individuals navigate complex financial concepts, identify potential risks, and create a customized plan that aligns with their retirement goals.

Conclusion

In conclusion, a simple retirement calculator is a valuable tool that individuals can use to estimate their retirement needs and plan for a secure financial future. By inputting key financial information, adjusting variables, and visualizing retirement savings over time, individuals can get a clearer picture of how much they need to save for retirement. Using a retirement calculator can help individuals set realistic financial goals, identify potential gaps in their savings, and make informed decisions about their retirement planning. By following the tips and avoiding common mistakes outlined in this article, individuals can use a simple retirement calculator effectively to create a customized retirement plan that meets their specific needs. Start using a simple retirement calculator today to take the first step towards a financially secure retirement.