Retirement Planning at 50: Why it’s Important

As you approach your 50s, retirement may start to feel more like a reality than a distant dream. This is a crucial time to assess your financial situation and make sure you are on track to retire comfortably. While retirement planning at any age is important, the decisions you make in your 50s can have a significant impact on your future financial security.

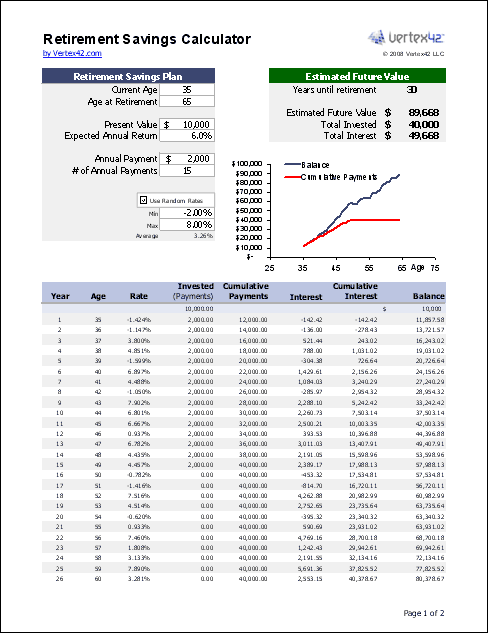

One of the key reasons why retirement planning at 50 is so crucial is that you still have time to make changes and adjustments to your savings and investment strategies. By starting to plan for retirement in your 50s, you can take advantage of the power of compound interest and ensure that your nest egg has time to grow before you retire.

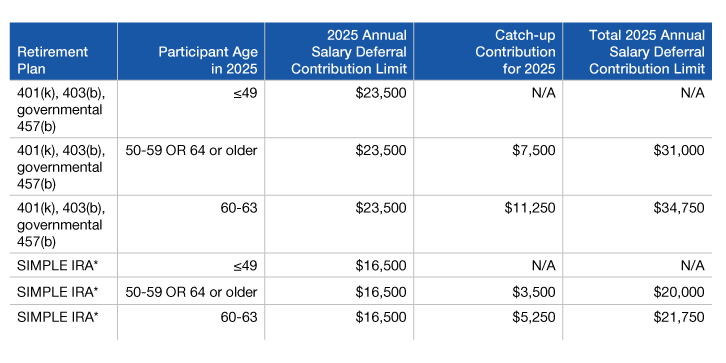

Another important reason to prioritize retirement planning at 50 is that this is often the time when many people reach their peak earning years. By maximizing your savings during this time, you can take advantage of higher contributions limits for retirement accounts and potentially catch up on any savings that you may have missed out on in earlier years.

In addition to the financial benefits of retirement planning at 50, there are also emotional and psychological benefits to consider. By having a clear plan in place for your retirement years, you can reduce stress and anxiety about your financial future and enjoy peace of mind knowing that you have taken the necessary steps to secure your retirement.

Steps to Take for Retirement Planning at 50

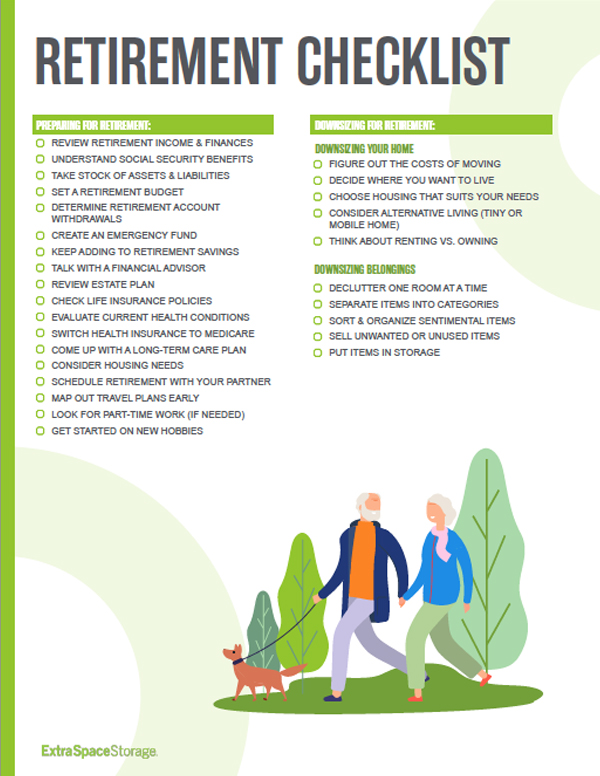

When it comes to retirement planning at 50, there are several key steps that you can take to ensure that you are on track to meet your financial goals. First and foremost, it’s important to assess your current financial situation and determine how much you will need to save for retirement. This can involve calculating your expected expenses in retirement, taking into account factors such as healthcare costs, travel expenses, and any other lifestyle choices you plan to make.

Once you have a clear understanding of your retirement savings goals, the next step is to maximize your contributions to retirement accounts such as a 401(k) or IRA. At age 50, you are eligible to make catch-up contributions to these accounts, which can help you significantly boost your retirement savings in the years leading up to retirement.

Another important step to take for retirement planning at 50 is to diversify your investment portfolio to ensure that you are well-positioned to weather market fluctuations and achieve long-term growth. This can involve working with a financial advisor to develop an investment strategy that aligns with your risk tolerance and retirement goals.

Challenges of Retirement Planning at 50

While retirement planning at 50 can offer many benefits, there are also some challenges that you may face along the way. One of the biggest challenges for many individuals in their 50s is balancing competing financial priorities, such as saving for retirement, paying off debt, and supporting children or aging parents. It can be difficult to find the right balance between these competing priorities and ensure that you are making progress towards your retirement goals.

Another challenge of retirement planning at 50 is the potential for unexpected expenses or financial setbacks. As you get closer to retirement age, it’s important to have a plan in place for how you will handle any unexpected expenses, such as medical emergencies or home repairs, without derailing your retirement savings goals.

Additionally, many individuals in their 50s may be facing a lack of retirement savings due to factors such as job loss, divorce, or inadequate savings habits in earlier years. If you find yourself in this situation, it’s important to take proactive steps to increase your savings and make up for lost time in order to secure a comfortable retirement.

Benefits of Starting Retirement Planning at 50

While retirement planning at 50 may come with its challenges, there are also many benefits to starting this process early. One of the key benefits is the ability to take advantage of catch-up contributions to retirement accounts, which can help you significantly boost your savings in the years leading up to retirement. By maximizing your contributions in your 50s, you can make up for any savings that you may have missed out on in earlier years and increase your chances of retiring comfortably.

Another benefit of starting retirement planning at 50 is the opportunity to assess your overall financial situation and make any necessary adjustments to your savings and investment strategies. By taking a proactive approach to retirement planning, you can ensure that you are on track to meet your financial goals and make any changes needed to achieve the retirement lifestyle you desire.

In addition to the financial benefits of starting retirement planning at 50, there are also emotional and psychological benefits to consider. By having a clear plan in place for your retirement years, you can reduce stress and anxiety about your financial future and enjoy peace of mind knowing that you have taken the necessary steps to secure your retirement.

Common Mistakes to Avoid in Retirement Planning at 50

When it comes to retirement planning at 50, there are several common mistakes that individuals may make that can hinder their ability to achieve their financial goals. One of the biggest mistakes is failing to maximize contributions to retirement accounts such as a 401(k) or IRA. By missing out on these contributions, you may be leaving valuable savings on the table and potentially jeopardizing your ability to retire comfortably.

Another common mistake in retirement planning at 50 is failing to diversify your investment portfolio to reduce risk and maximize growth potential. By putting all of your eggs in one basket, you may be exposing yourself to unnecessary risk and missing out on opportunities for long-term growth. Working with a financial advisor to develop a diversified investment strategy can help you avoid this mistake and ensure that you are well-positioned for retirement.

Finally, a common mistake to avoid in retirement planning at 50 is underestimating your expected expenses in retirement. Many individuals fail to properly account for factors such as healthcare costs, travel expenses, and inflation when calculating their retirement savings goals. By underestimating these expenses, you may find yourself falling short of your financial goals in retirement and struggling to maintain your desired standard of living.

Strategies for Catching Up on Retirement Savings at 50

If you find yourself behind on your retirement savings goals at age 50, there are several strategies that you can employ to catch up and ensure that you are on track for a comfortable retirement. One of the first steps to take is to maximize your contributions to retirement accounts such as a 401(k) or IRA. At age 50, you are eligible to make catch-up contributions to these accounts, which can help you significantly boost your savings in the years leading up to retirement.

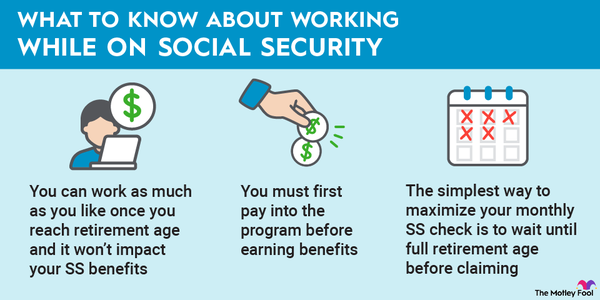

Another strategy for catching up on retirement savings at 50 is to consider delaying retirement by a few years in order to give yourself more time to save and grow your nest egg. By working a few extra years, you can increase your Social Security benefits and potentially reduce the amount of savings you will need to retire comfortably.

In addition to maximizing contributions and delaying retirement, another strategy for catching up on retirement savings at 50 is to reduce your expenses and increase your income in order to free up more money for savings. This can involve cutting back on discretionary expenses, downsizing your home, or taking on a side job to boost your income and accelerate your savings growth.

Retirement Planning Vehicles to Consider at 50

When it comes to retirement planning at 50, there are several vehicles that you may consider to help you achieve your financial goals. One popular option is a traditional 401(k) or IRA, which offer tax advantages and potential employer matching contributions to help you grow your savings over time. At age 50, you are eligible to make catch-up contributions to these accounts, which can help you boost your savings in the years leading up to retirement.

Another retirement planning vehicle to consider at 50 is a Roth IRA, which offers tax-free growth and withdrawals in retirement. By contributing to a Roth IRA, you can diversify your tax strategy and potentially reduce your tax burden in retirement. Additionally, a Roth IRA does not have required minimum distributions, so you can let your savings grow tax-free for as long as you like.

In addition to traditional retirement accounts, another vehicle to consider for retirement planning at 50 is a health savings account (HSA). An HSA offers triple tax advantages, allowing you to contribute pre-tax dollars, grow your savings tax-free, and make tax-free withdrawals for qualified medical expenses in retirement. By contributing to an HSA, you can save for healthcare costs in retirement and potentially reduce your overall retirement expenses.

Conclusion

As you approach your 50s, retirement planning becomes more important than ever. By taking the time to assess your financial situation, maximize your contributions, and diversify your investments, you can ensure that you are on track for a comfortable retirement. While there may be challenges along the way, starting retirement planning at 50 offers many benefits and can help you achieve your financial goals in the years ahead. By avoiding common mistakes, employing strategies to catch up on savings, and considering the right retirement planning vehicles, you can set yourself up for a secure and fulfilling retirement. Start planning for your future today and take control of your financial future.